My summary of Taktile before using it – An automated compliance platform.

How does Taktile explain itself in the first minute? When I go to the Taktile website I quickly realise that it’s more than just a compliance platform. Taktile positions itself as “The Decision Platform for the AI Age” and it specialises in intelligent decision flows and agents for financial institutions’ most critical decisions.

This description puts Taktile in the same bucket as companies like Provenir, Alloy and Scienaptic. These are all companies that provide AI-powered decisioning for financial services, particularly around credit risk, fraud detection and compliance automation. The problem that Taktile is trying to solve is the time it currently takes financial institutions to process lending applications, with underwriting tasks and processes being highly time consuming and manual.

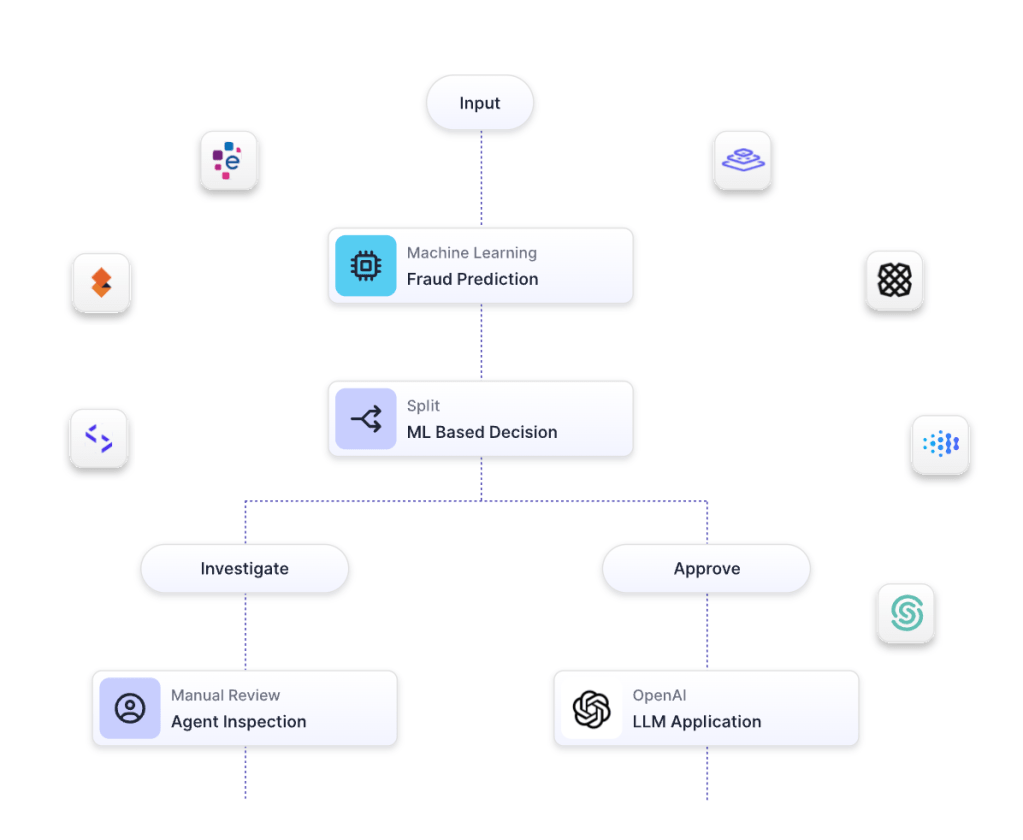

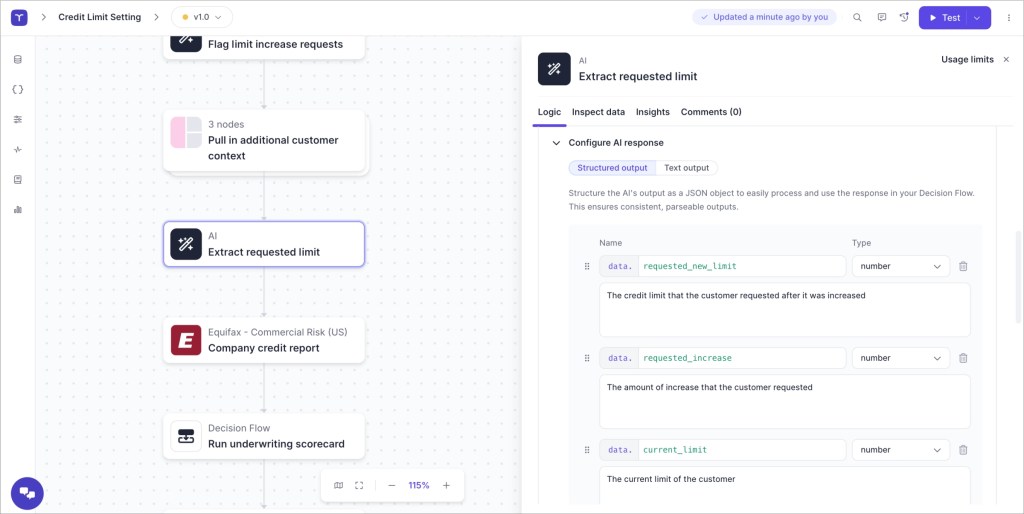

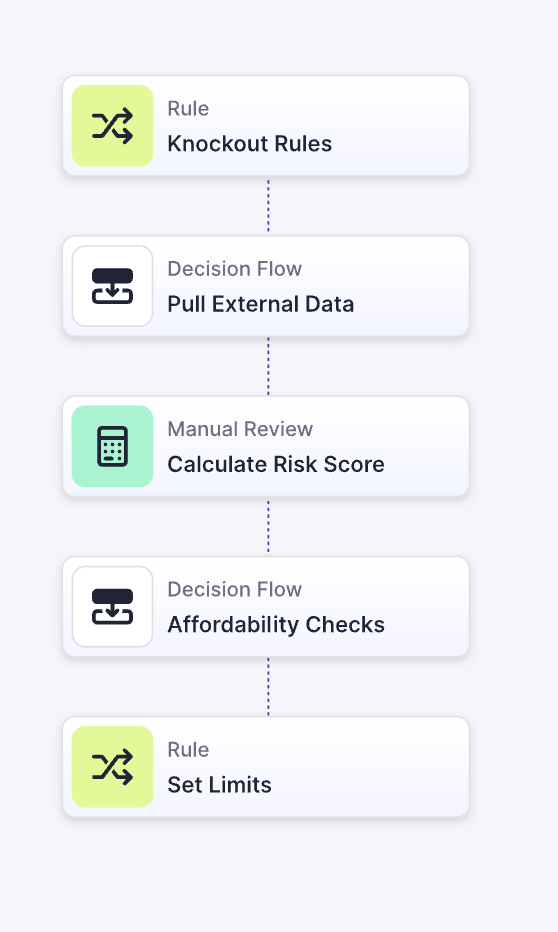

How does Taktile work? Taktile’s “Decisioning Workbench” lets companies build their own agentic workflows. You can create agents to carry out specific tasks such as extracting key data points from uploaded documents and analysing financial statements.

You can add “AI nodes” to your workflow to use LLMs in your decision flows and leverage their responses for your decisioning logic. These pre-built nodes represent business rules and predictive models.

The solution that Taktile provides is an agentic platform that operates alongside underwriters, each agent carrying out a designated task (e.g. extracting key data points from uploaded documents or analysing financial statements to assess risk). In addition to lending applications, Taktile’s solution caters for these use cases: onboarding, credit, fraud, compliance and collections.

Taktile offers a drag-and-drop interface which is designed to make it as intuitive as possible for non-technical back-office employees to create and customise their workflows and reduce decision time. It features an AI Copilot that helps users generate decision logic from plain language descriptions, understand existing code and debug issues.

You can pick additional external data sources to incorporate into your workflows using Taktile’s data marketplace with out-of-the-box integrations to third-party data providers ranging from cloud providers to credit bureaus.

Main learning point: Taktile shows how AI can make financial decisioning much more efficient. It’s one of those products that uses AI to enables banks and lenders to ‘do more and do it faster’ (while maintaining accuracy).

Related links for further learning: