-

Learning about automated prompts

Most of the prompts we write are done manually — you type something into ChatGPT or Claude and wait for a response. But there’s a whole other world of prompting happening behind the scenes, where developers write code that assembles and fires off prompts automatically, thus reducing the manual effort in prompt creation and tuning.…

-

Claude’s Legal Productivity Plugin: what it means for Legal Tech

Last week, shares in Europe’s biggest data, publishing and legal software groups took a hit when Anthropic unveiled a legal productivity plugin. This is an AI-powered productivity plugin for in-house legal teams, automating contract review, NDA triage, legal briefings and template responses. It’s primarily designed for Cowork but also works in Claude Code. The plugin…

-

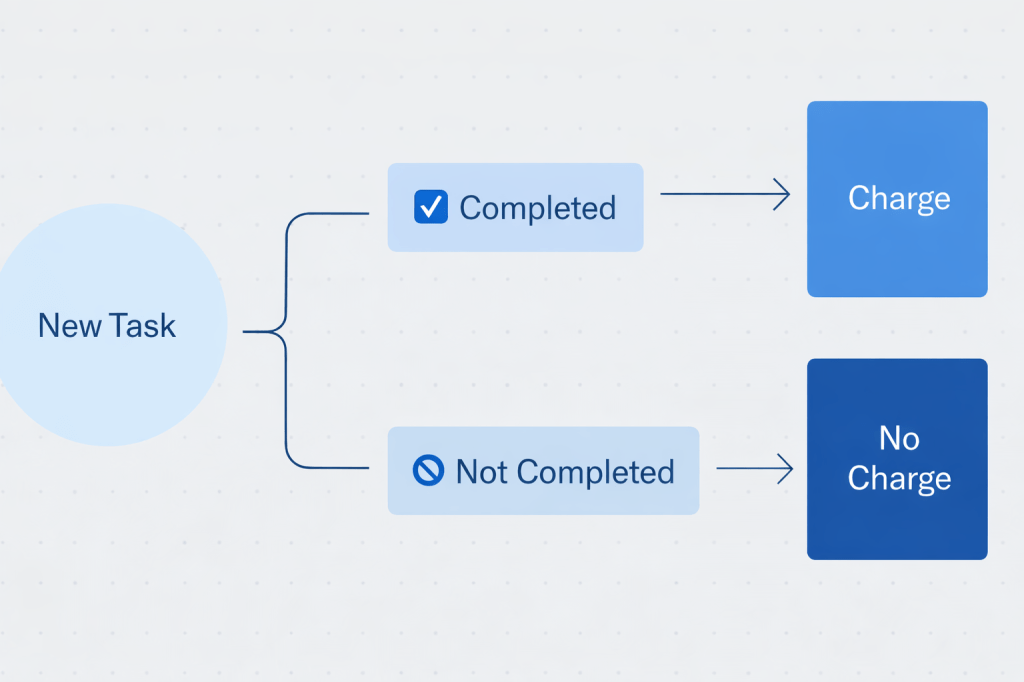

Outcome based pricing

I’ve written about pricing before and value based pricing in particular. Value-based pricing sets prices mostly based on the customer’s value perception or willingness to pay, rather than on production cost or competitor pricing. Fixed or variable pricing models are most common among software companies, with vendors either charging a seat-based or usage-based rate. With…

-

From SEO to AEO

From Search Engine Optimisation to Answer Engine Optimisation (AEO) means we’re shifting from links to hyper-specific answers and context. AEO is about making your content discoverable by answer engines like ChatGPT, Perplexity, Gemini and Claude. These AI agents find, synthesise and reuse content in response to user prompts. With traditional SEO, users click a link…

-

“Transformed” (Book Review)

Marty Cagan’s latest book “Transformed: Moving to the Product Operating Model” is about companies wanting to transform so they can take advantage of new opportunities and respond to serious threats. I’m sure many of you have been part of companies going through an ‘Agile transformation’ or are now witnessing ‘AI transformation’. In Transformed, Cagan and…