My summary of Comply Advantage before using it – Automated Anti Money Laundering (AML) compliance.

Why AML compliance is painful? Having worked with banks previously, I’ve seen first hand the challenges and intricacies of AML – incorporating AML checks into user journeys as well as ongoing risk monitoring.

How does ComplyAdvantage explain itself in the first minute? “FinCrime compliance re-engineered. An integrated platform built for speed. Modernizing financial crime risk management for high performance enterprises.”

I’m particularly interested in what is included in ComplyAdvantage’s integrated platform, enabling customers to battle financial crime:

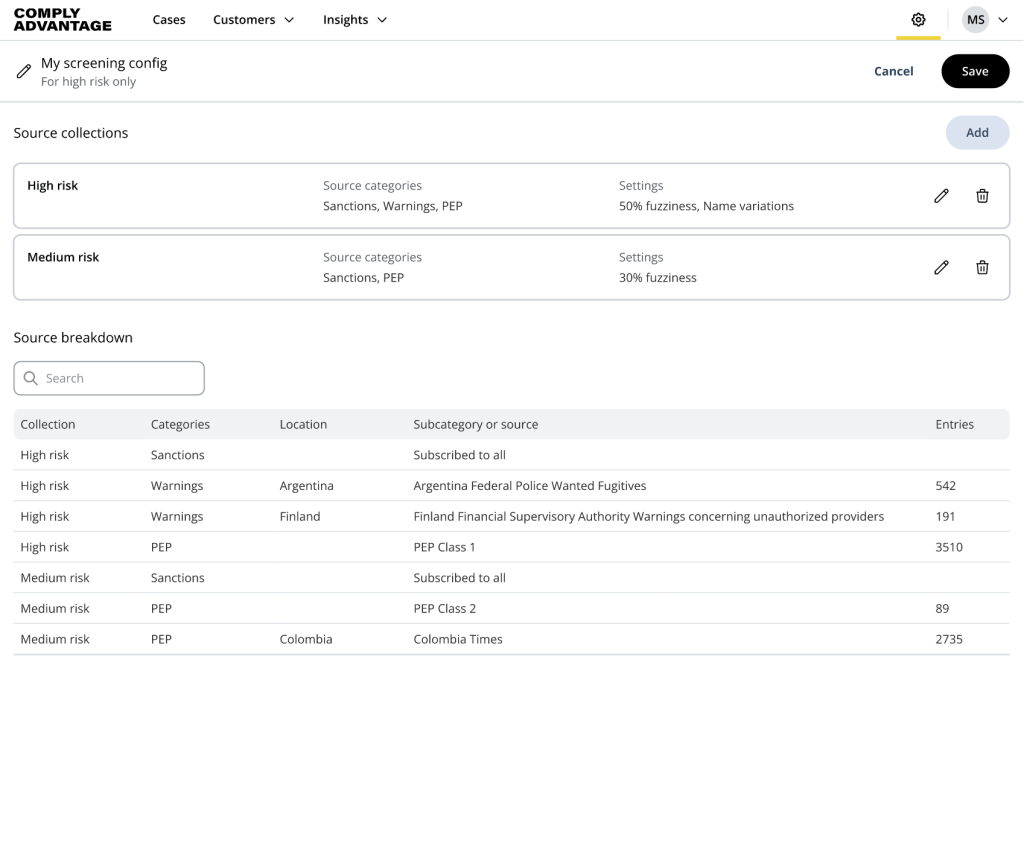

Customer Screening – Continuous monitoring of business customers for compliance with internal and regulatory requirements. ComplyAdvantage automatically flags hits, screening for sanctions, regulatory and law enforcement actions, and negative media content. Users can configure customer screening to meet their specific risk and cost of compliance goals. For example, automated risk assessments allow teams to focus on highest-risk customers first rather than wading through hundreds of false positives.

Looking at above screenshot I wonder about the configurability of the screening dashboard designed for compliance teams. How easy is it to add a new “source collection” or change the “settings” to reflect internal compliance standards?

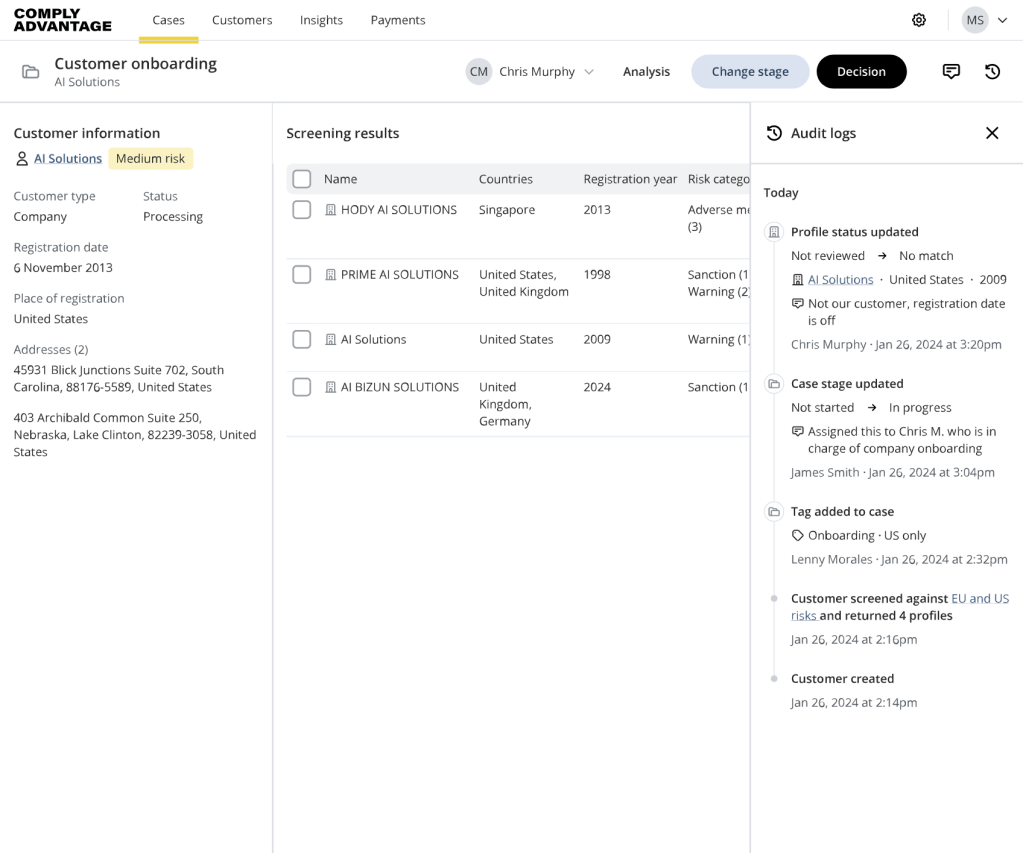

Company Screening – Similar to customer screening, ComplyAdvantage automates the screening of companies for sanctions, regulatory and law enforcement actions, and negative media content.

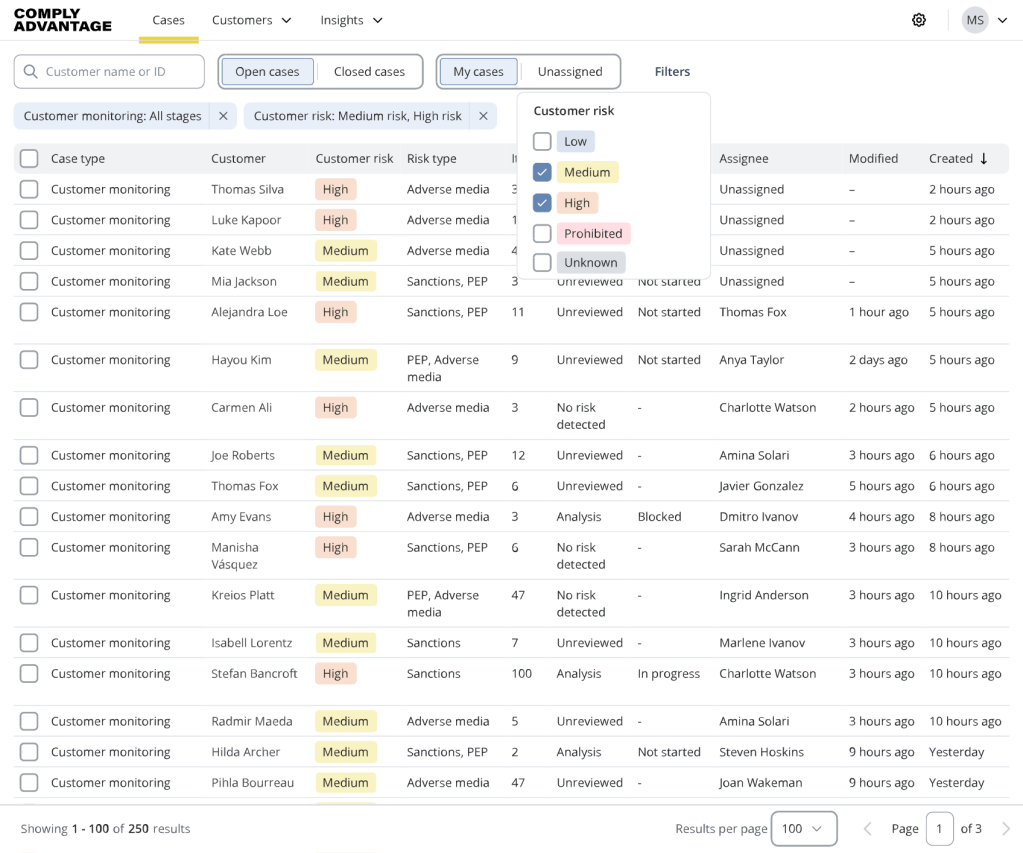

Ongoing monitoring – ComplyAdvantage provides an API endpoint that enables customers to continuously monitor risk profiles. Companies integrate this endpoint directly into their risk assessment workflows and alerts are triggered automatically. Looking at the different visa

I presume the risk statuses in the above dashboard visual are populated automatically, using predictive analytics. What I’m less clear about is how the above interface caters for changes in a customer’s risk profile. Does the bank’s compliance team receive an automated alert which links to the customer’s dashboard entry, with a timestamp of when the change was detected (and reasons why)?

Points of differentiation – Legacy AML systems are often very manual, based on static data. Dynamic data is where providers like ComplyAdvantage want to stand out; using AI to detect emerging risks in real-time.

Main learning point: ComplyAdvantage solves a genuine pain point for financial services companies – scaling manual AML compliance whilst managing costs and regulatory risk. By automating screening and using AI to reduce false positives, they’re helping back office heavy companies significantly reduce operational overhead and become much more accurate in their fraud detection.